Product Description

Includes everything you need for your self-employment and personal income taxes.

Amazon.com

TurboTax Home & Business includes everything taxpayers need for self-employment and personal income taxes. Designed for taxpayers who have their own business, TurboTax Home & Business includes everything in TurboTax Premier plus an expanded interview that guides customers step-by-step through Schedule C, categorizing business expenses, maximizing home office deductions and calculating and reporting depreciation.

Asks easy questions about your businessAsks you questions in plain English, then puts your info on the right business tax forms for you.

Maximizes personal and business deductionsWe search for more than 350 personal and self-employment deductions to get you the biggest tax refund possible--guaranteed.

Efile for a fast refundEfile with direct deposit to get your refund in as few as 8 days. Federal efile included.

Everything you need to easily do your personal and business taxes.

Provides Guidance for Self-Employment Income and Deductions New easier interview customizes questions based on your business profile (sole-proprietor, consultant, 1099 contractor, and single-owner LLC) and gives you step-by-step guidance for entering income and expenses.

Helps Find Small-Business Tax Deductions Shows you which expenses you can deduct for your vehicle, supplies, utilities, home office expenses, and more, so you get every business deduction you deserve.

Identifies Industry-Specific Deductions Walks you through tax write-offs by industry to help you spot commonly overlooked deductions.

Gets You the Biggest Vehicle Deduction Shows you whether you'll get a bigger deduction using actual expenses or the standard mileage rate. Provides extra help for splitting vehicle expenses between business and personal use.

Makes Entering Income Easier Shows all business income types on a single page so you know you've covered all sources of business income.

Creates W-2 and 1099 Forms Helps you prepare unlimited forms for employees and contractors. Does all calculations and prints on plain paper. No special forms needed.

Improved--Simplifies Asset Depreciation Helps you determine which depreciation method will get you the biggest deduction, then guides you through calculating and reporting depreciation.

Streamlines Expense Entry Walks you t

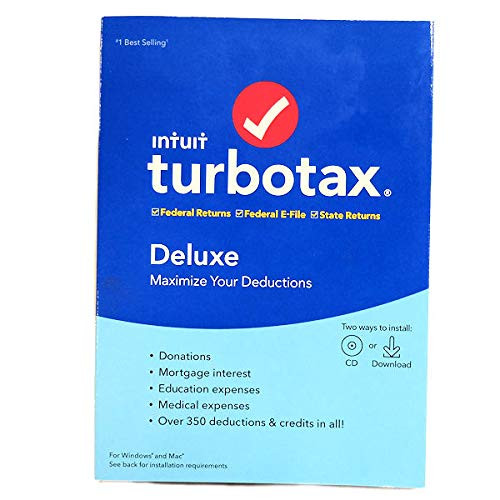

TurboTax Home and Business Federal plus State plus eFile 2008 -OLD VERSION-

Was:

$107.78

Now:

$53.89

- SKU:

- RTW176513

- UPC:

- 28287420441

- Condition:

- New

- Availability:

- Free Shipping from the USA. Estimated 2-4 days delivery.

![TurboTax Home & Business Federal + e-File + State 2010 - [Old Version] TurboTax Home & Business Federal + e-File + State 2010 - [Old Version]](https://cdn11.bigcommerce.com/s-t8bvbs505h/images/stencil/500x659/products/24525484/26019414/71EpZxvX5WL__20456.1696824782.jpg?c=2)